Problem: Every invoice was treated as high risk, creating manual effort, delays, and operational bottlenecks

Role: Senior UX Designer

Scope: Internal enterprise tooling, auditing workflows, risk evaluation logic

Outcome: Reduced manual review, faster funding decisions, and improved operational efficiency without increasing financial risk

What This System Is Responsible For

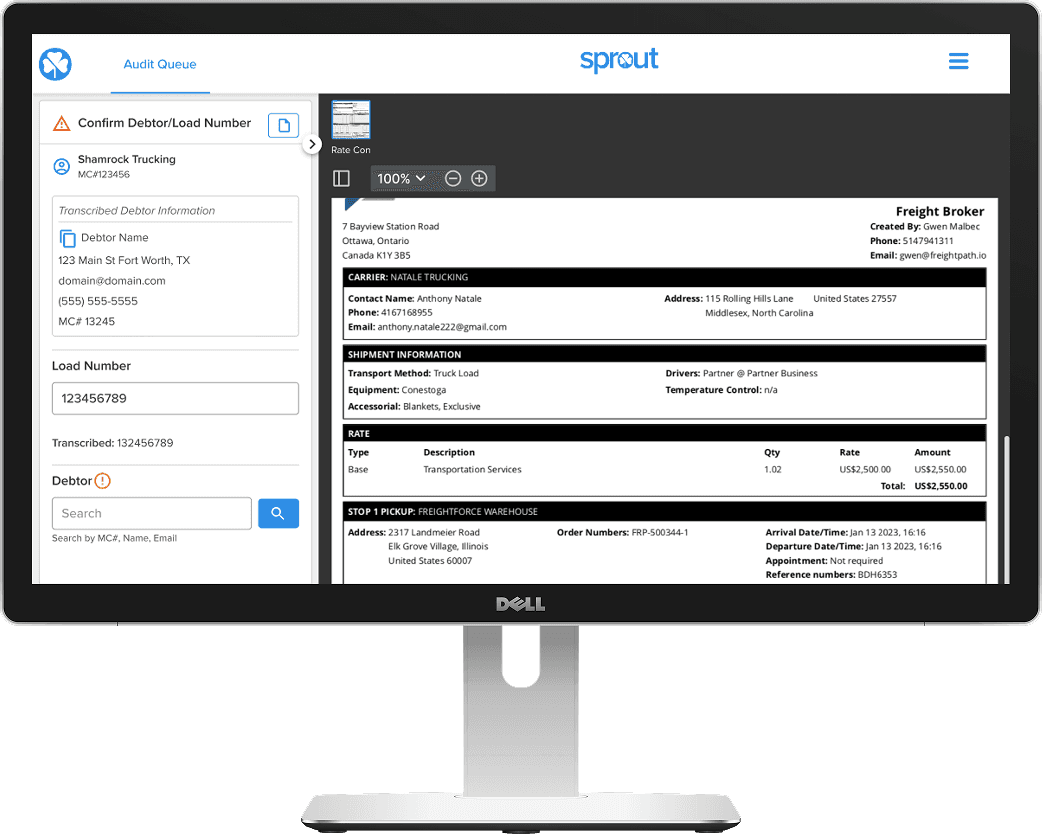

This system supports invoice auditing for funding decisions, helping teams decide when manual review is necessary and when invoices can safely move forward automatically.

Before this work, auditors treated nearly every invoice as high risk. While this reduced exposure, it created significant operational drag and slowed funding decisions across the business.

Why Manual Review Was No Longer Sustainable

Invoice volume continued to grow, but the auditing process didn’t evolve with it. Auditors spent time reviewing invoices that posed little to no risk, leaving less capacity for cases that actually required investigation.

What worked at lower volume became increasingly difficult to sustain as the business scaled.

When Everything Became High Risk

By default, every invoice enters the same review path, regardless of context. Invoices tied to long-standing relationships or predictable patterns were handled with the same scrutiny as true edge cases. Over time, auditing shifted from risk management to process maintenance.

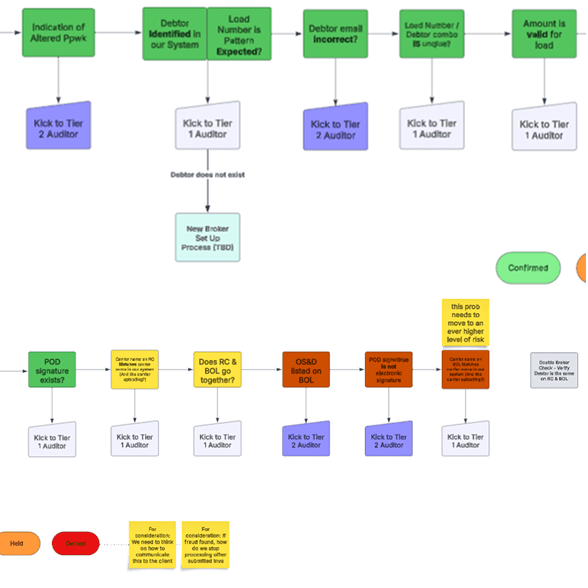

Reframing Automation Around Confidence

Rather than asking which invoices could be fully automated, we reframed the problem around risk confidence. Automation wasn’t about removing people from the process. It was about identifying when confidence was high enough to proceed without review, and when uncertainty justified human intervention.

Defining meaningful risk signals clarified where automation could safely replace routine review.

Deliberate tradeoffs balanced flexibility, clarity, and delivery constraints.

What Changed in Practice

After launch, the impact was clear. Manual reviews dropped significantly for low-risk invoices, funding decisions moved faster without increasing exposure, and auditors were able to focus on genuinely high-risk cases.

Reflections & Impact

This work changed how the organization approached auditing. By shifting from blanket review to confidence-based evaluation, teams were able to move faster without sacrificing financial control.

The biggest impact wasn’t just efficiency; it was clarity.

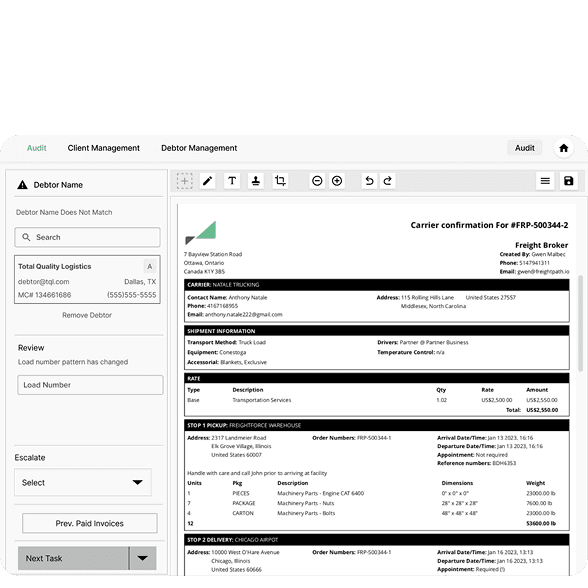

Additional Design Considerations

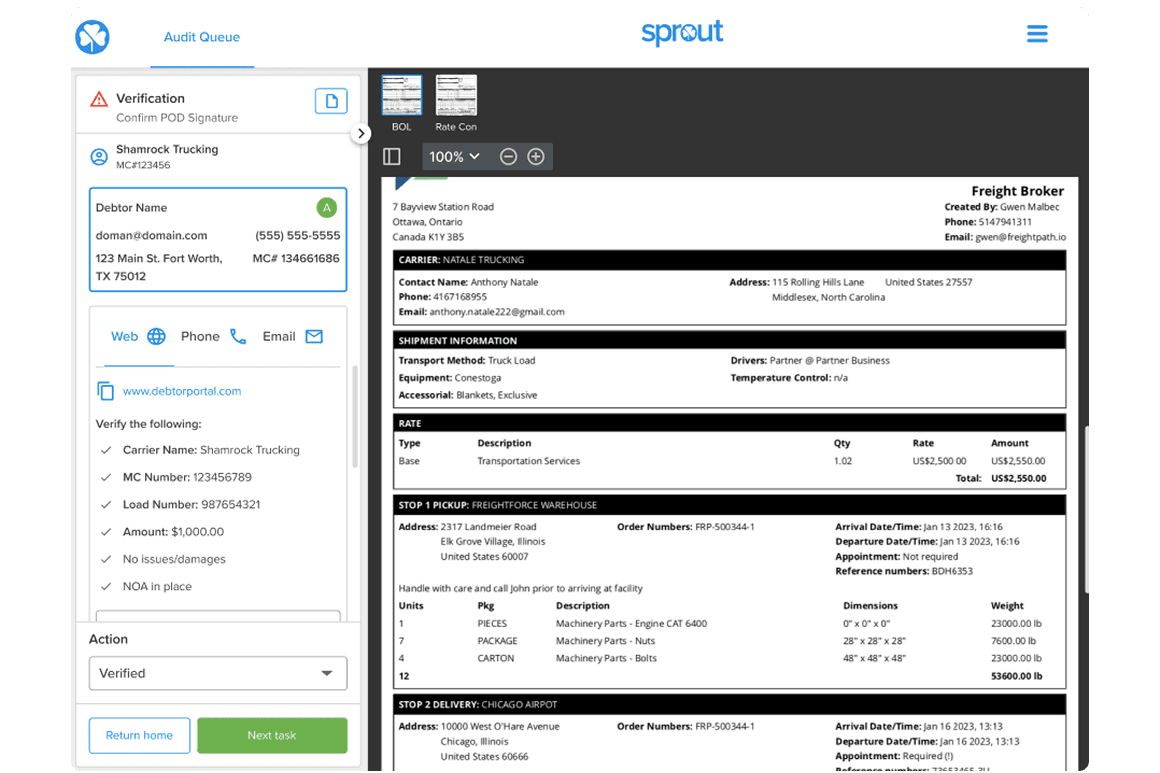

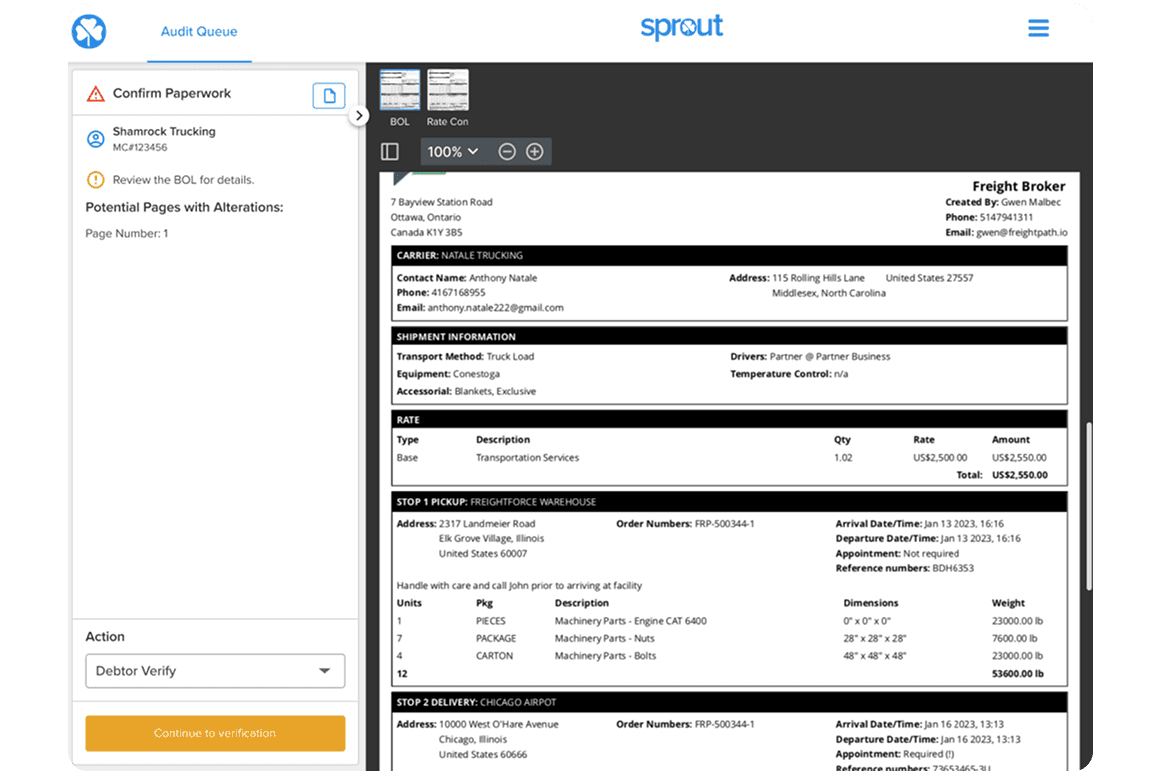

The secondary verification workflow is triggered when additional review is required beyond the initial audit

Selecting a secondary workflow from the initial stage to progress the invoice

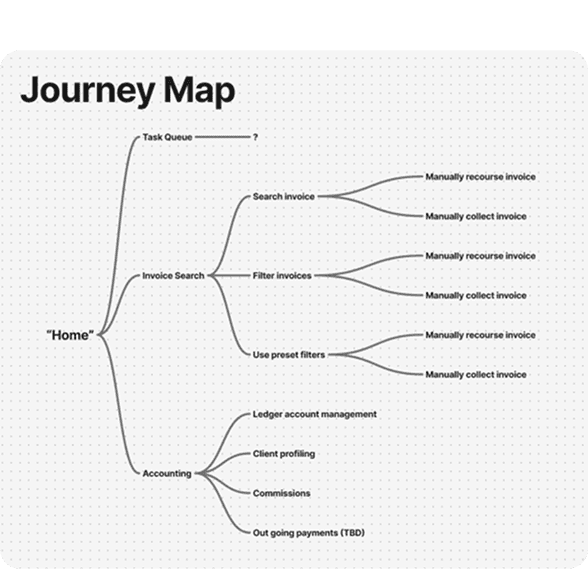

The site map for one section of this application during the planning stages.