At a Glance

Project Type: Internal enterprise platform

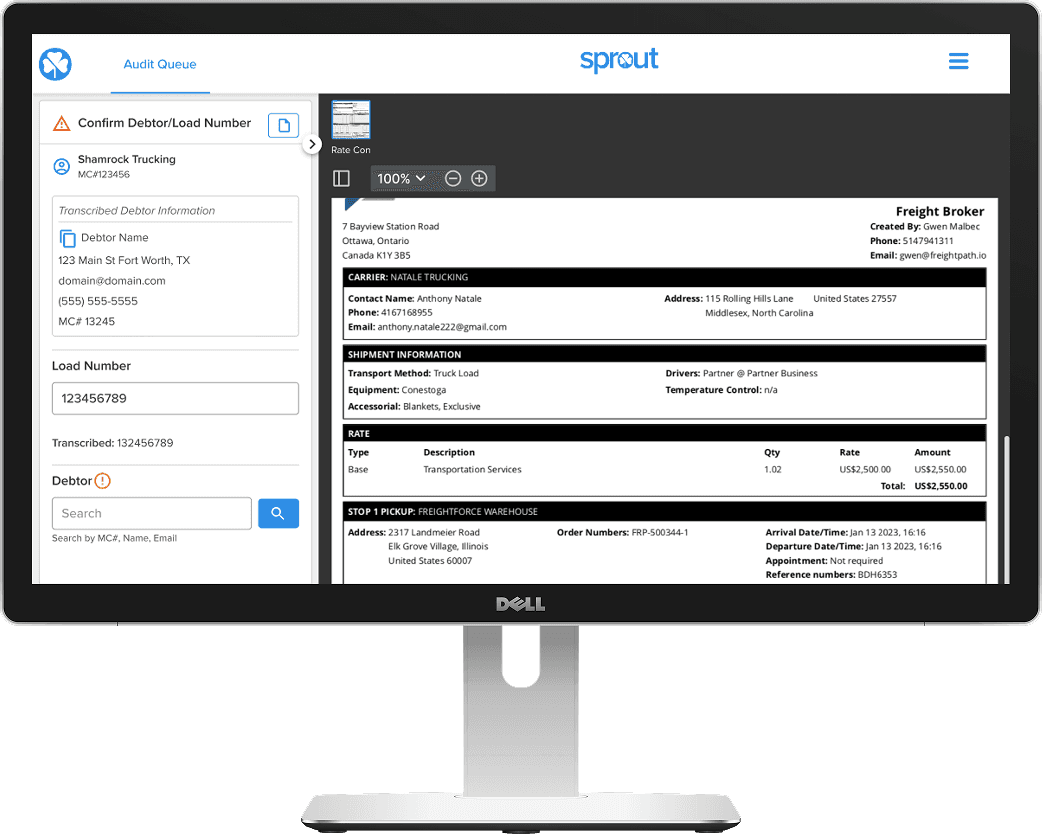

Focus: Risk-based invoice auditing and funding automation

Responsibilities: Workflow design, interaction design, cross-functional alignment

Users: Internal audit and funding teams

Overview

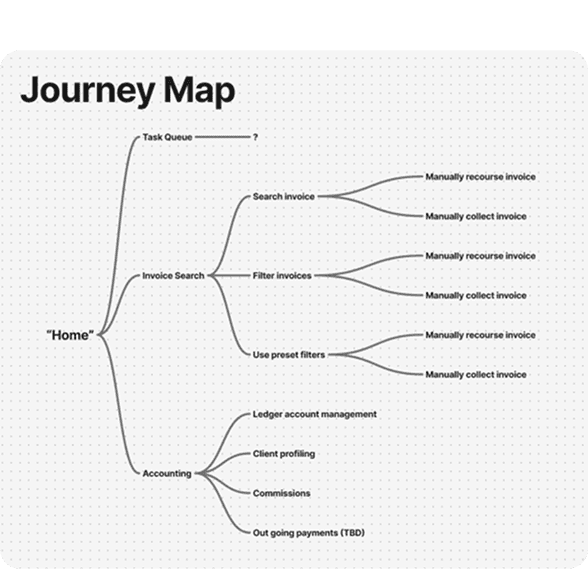

This project is part of a larger internal effort to modernize how invoice risk is evaluated at the point of funding. Today, every client invoice is subject to the same final manual review, regardless of history, volume, or demonstrated risk profile. While this approach provides consistency, it also introduces friction for trusted clients and adds significant operational overhead as invoice volume scales.

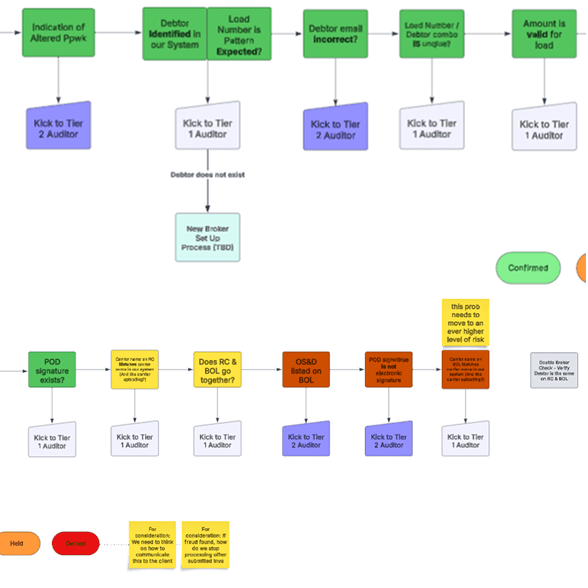

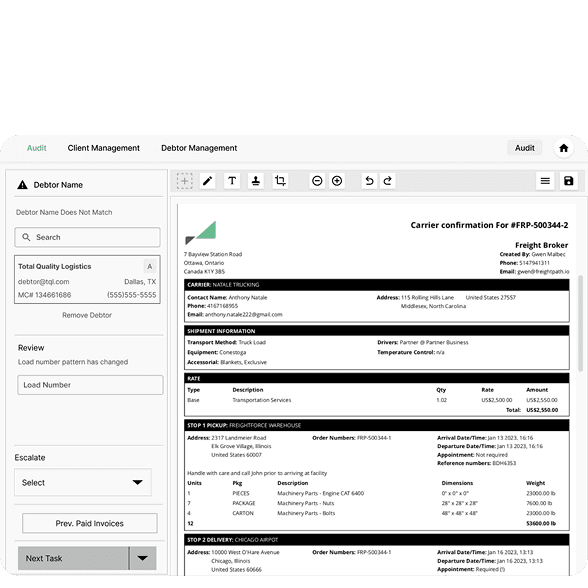

The objective of this work is to introduce a risk-based auditing system that allows low-risk invoices to fund automatically, while ensuring higher-risk cases still receive deliberate human review. The system is designed to improve speed without sacrificing control, transparency, or confidence in funding decisions.

The Problem

Once an invoice passes initial audit checks and there is high confidence it will result in payment from the debtor, a secondary client review is still required before funding. This review is applied uniformly across all clients, including those with long-standing relationships and consistently clean histories.

Over time, this created two compounding issues:

Manual approval effort increased as invoice volume grew

Low-risk clients experienced funding delays that did not meaningfully reduce organizational risk

Auditors already evaluate a variety of factors when reviewing a client, such as business stability, outstanding balances, invoice history, and behavioral patterns that may indicate fraud or operational strain. However, these considerations were not consistently structured or used to determine whether a human review was actually necessary.

Historically, the funding moment has been the most effective point to address uncertainty, since funds can be held if additional information is required. The challenge was identifying when that leverage added value, and when it did not.

Defining Success

Because the system is still being built, success was intentionally defined around operational behavior and observable outcomes, rather than finalized performance metrics.

We aligned on three categories of measurement:

Inputs: the number of invoices that bypass manual approval

Outputs: changes in cost per invoice, time spent approving invoices, and speed to funding

Observations: client satisfaction related to funding speed

This framework allowed teams to evaluate whether the system is working as intended once live, without overstating impact during the design phase.

Defining meaningful risk signals clarified where automation could safely replace routine review.

Deliberate tradeoffs balanced flexibility, clarity, and delivery constraints.

Current State & Early Signals

The application is still in active development, so final performance metrics are not yet available. However, early usability testing has surfaced encouraging signals:

Faster completion of approval-related tasks

Reduced abandonment in complex or edge-case workflows

Increased user confidence when making funding decisions

These early indicators suggest that removing unnecessary review does not reduce oversight when decisions are clearly explained and easy to intervene on.

Takeaways & Next Steps

This project reinforced the importance of designing automation as a collaboration between system logic and human judgment. Speed alone is not the goal — clarity and confidence are what make automation sustainable.

Next steps include validating real-world impact post-launch, monitoring where automation confidence breaks down, and iterating based on observed behavior rather than assumptions. Shipping a focused first version provides a strong foundation to evolve the system responsibly over time.

Additional Design Considerations

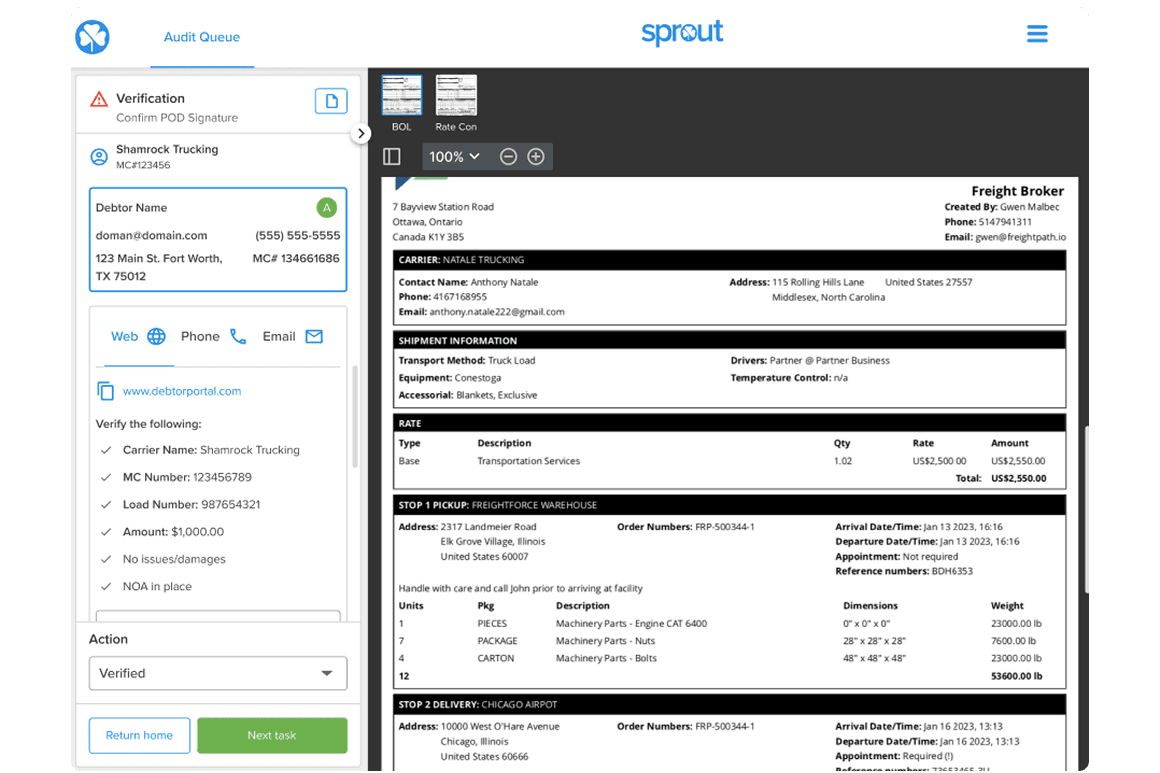

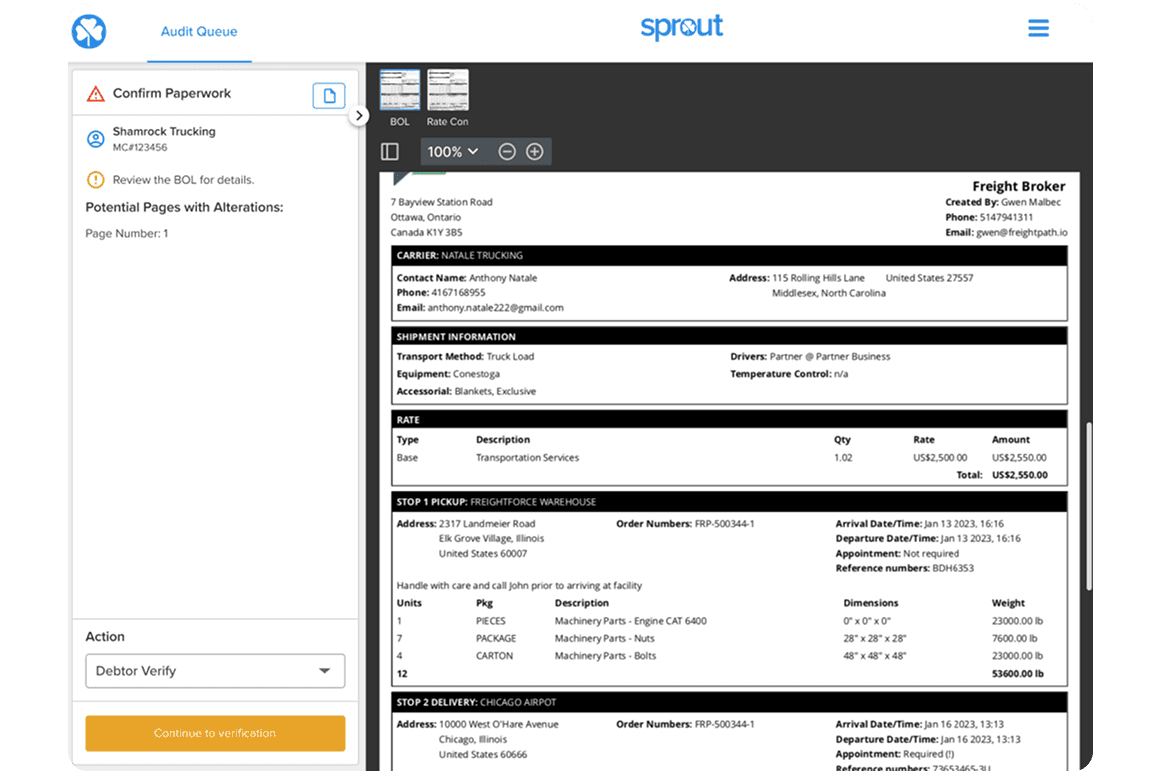

The secondary verification workflow is triggered when additional review is required beyond the initial audit

5

6

7